Annuities Insurance

life insurance annuities | insurance companies that sell annuities | annuities insurance

Annuities have become quite a rage these days. People want to carry on with the same kind of lifestyle even after their retirement and that is why they pay up a certain amount regularly for a period of 20 to 25 years so that after they stop working, they can enjoy the benefits of a regular monthly income. The amount of return which you would get would totally depend upon the amount you paid an annuity.

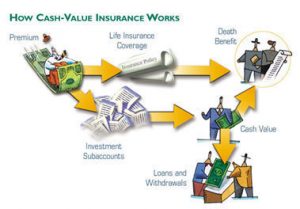

Annuities are basically contracting with insurance companies. They are investment plans that can be both a qualified retirement plan or vice versa. In the case of being nonqualified annuities, one can contribute large amounts of savings, tax-deferred, until the age of 50½. The only tax that is required to be paid is based on the earnings of the account. The good thing about annuities is that different types of investors will be able to find different annuities suitable for themselves, whether to use fixed or variable annuities, depending on their style of investment.

Annuities are investment vehicles that have been around for ages. Most people have at the very least a basic understanding of what annuities are. However, due to the detailed nature of Medicaid Compliant Annuities, it can be a difficult concept to grasp…

Annuities are sometimes also equity-based, whereby you make either a large single payment or multiple smaller ones and the insurance company pays you in kind based upon the performance of something called an equity index, which varies depending upon the situation and the company. Often your contract will have a guaranteed payment amount and you won’t receive less than that no matter what the index results are.

Annuities are either classified as immediate or deferred. The immediate variety will begin to pay you at regular intervals after you have made the initial investment premium. In this case, the annuity rates you receive will be largely based on your age, gender, and the particular plan you have chosen. The alternative, deferred annuities must be paid into over a set period as defined in your contract. While each of these plans is different, there is some that function in a similar fashion to a CD in that the period of guaranteed interest is equal to the period of surrender penalty.

Annuities that make payments in fixed amounts or in amounts that increase by a fixed percentage are called fixed annuities. Variable annuities, by contrast, pay amounts that vary according to the investment performance of a specified set of investments, typically bond and equity mutual funds.

Using annuities can add so much to retirement. If you are close to retirement or in retirement, a serious look at annuities can change your life. Your income in retirement should be smooth and steady but if your underlying investments that are providing your income are not smooth and steady then watch out! You may in for a bumpy ride that you never wanted or needed to be on in the first place.

To find out more information on Annuities and how they can benefit your retirement, please give Choice Plus Benefits a call. Our knowledgeable insurance agents are ready to assist you in making the right retirement investment for you and your family.

What are Annuities?

They are contracts written by insurance companies agreeing to pay you, depending on your contract, a guaranteed, fixed, or equity return with no risk to your principal.

Law Suit and Creditor Proof

Section 72 Internal Revenue Code

- Fixed – Guaranteed rated and terms

- Equity Index – Guaranteed all principal, with the upward potential of stock market gains; no risk of a downturn.

- Taxes – Annuities pass through probate

- Probate – Annuities offer check-writing privileges

- Safety – Annuities are guaranteed by the legal reserve

- Options – Guaranteed lifetime income.

* Recommendation:

Good for all money you want to be guaranteed, or you want to be guaranteed to a special beneficiary.

After 5 pm, please call this number 972-567-5695.